Seeing Your Money Flow Clearly

Begin with read-only connections and enable two-factor authentication. Review permissions, disconnect anything you do not recognize, and store recovery codes securely. Ask us questions about security below—we’ll compile answers and practical steps for first-time users.

Seeing Your Money Flow Clearly

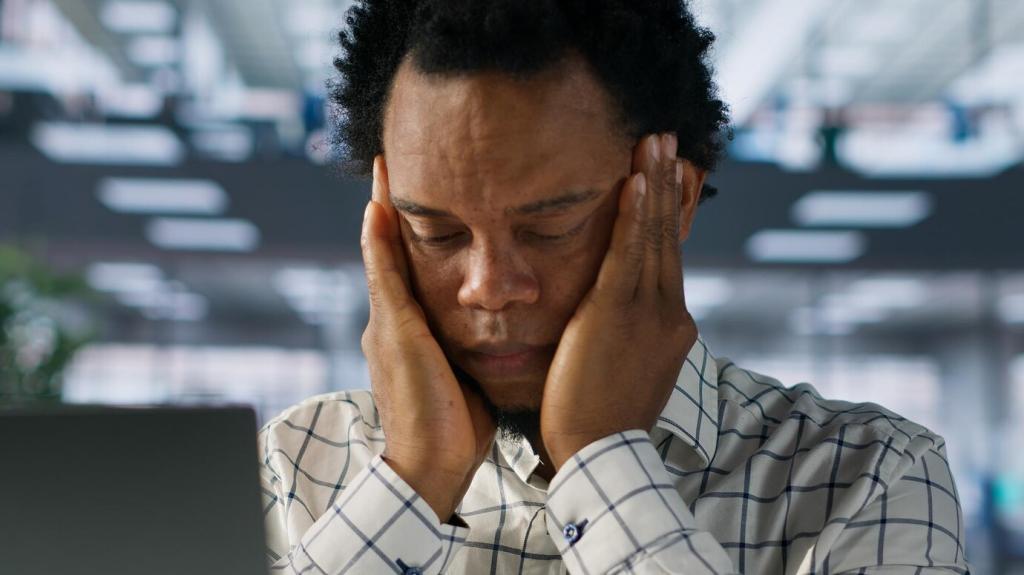

Choose two alerts only: one for unusually high spending and one for upcoming bills. Keep tones gentle and digest emails weekly. Over-notifying creates numbness; useful alerts build awareness without anxiety. Which two alerts would you enable first, and why?