Travel, Remittances, and Cross-Border Freedom

See exchange rates upfront, compare transfer methods, and avoid inflated markups. A clear breakdown of costs lets you choose the fastest or the most affordable option, instead of guessing and hoping for the best outcome.

Travel, Remittances, and Cross-Border Freedom

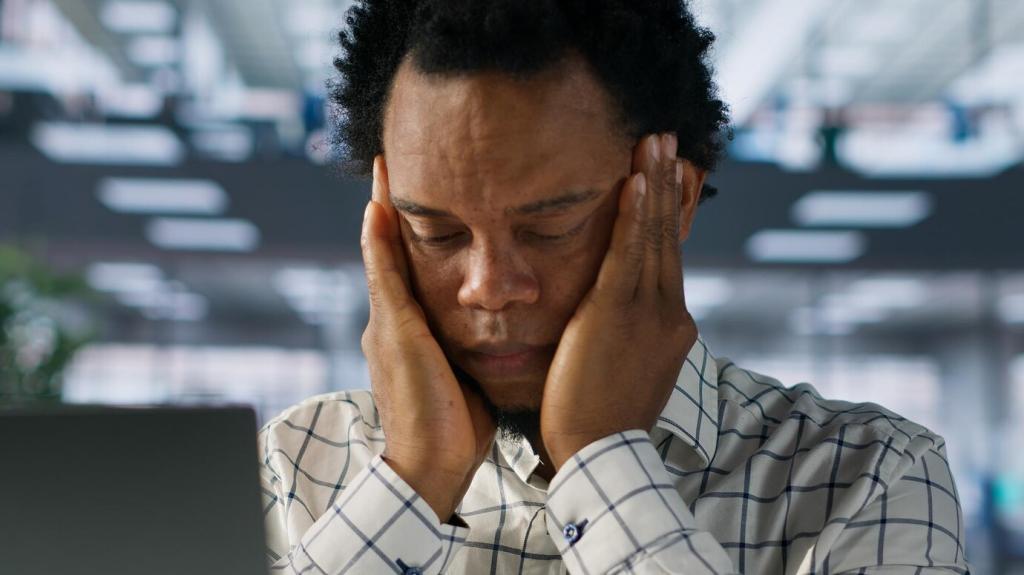

Freeze cards, set spending limits, and enable travel notifications—even with spotty data. You stay in control, and fraud checks adapt to location, reducing false declines while keeping your funds safe in unfamiliar places.